The NtInsight® financial risk management software applications are designed to meet present and future market requirements.

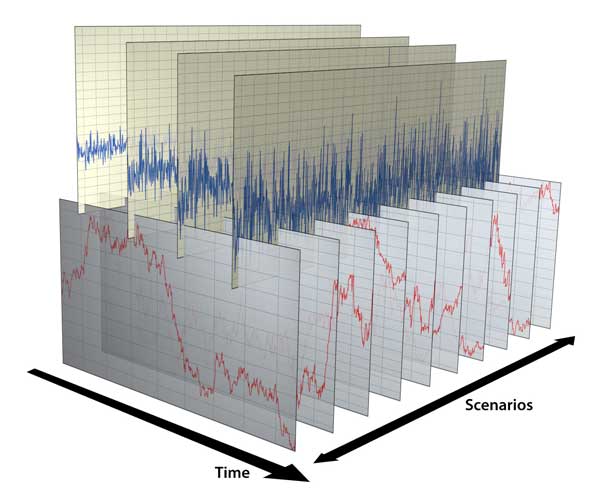

Daily Funding and Investment Planning Simulation

NtInsight offers an engine that performs daily simulations along a time axis. To calculate VaR, you need only calculate the market value at the end of a time horizon. However, if you need to know a portfolio’s actual behavior during fiscal periods for ALM purposes, you need to simulate daily funding operations, accounts settlement, and investment planning.

You also need to consider the amount of each chart of accounts by following each transaction’s T-accounts to avoid cash shortage or risk limit overrun. These processes require more calculation than a simple market or credit VaR.

NtInsight allows you to perform all these. How? The key is our HPC technology.

Powered by the latest HPC technologies, NtInsight supports a simulation process that is far more complex than what is currently available in the market.

Comprehensive Risk Calculations

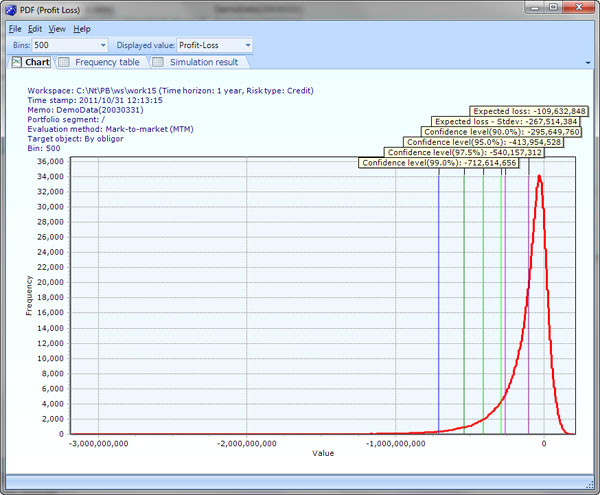

NtInsight calculates various risk indicators including VaR and tail-VaR (also called expected shortfall, conditional VaR, and expected tail loss) and their marginal risk factors, marginal VaR, and marginal tail-VaR.

NtInsight also calculates component VaR, which is a partial differential coefficient of VaR for each risk component. Analyze the impact of decomposed types of risk, such as currency risk, interest rate risk, equity risk, and credit risk and assess a portfolio’s risk from different perspectives using these indicators.

NtInsight provides risk contribution feature to analyze the impact of decomposed part of portfolio by, for example, business units, regions, and each obligor.

N=1,000,000 VaR chart representing fat tail.

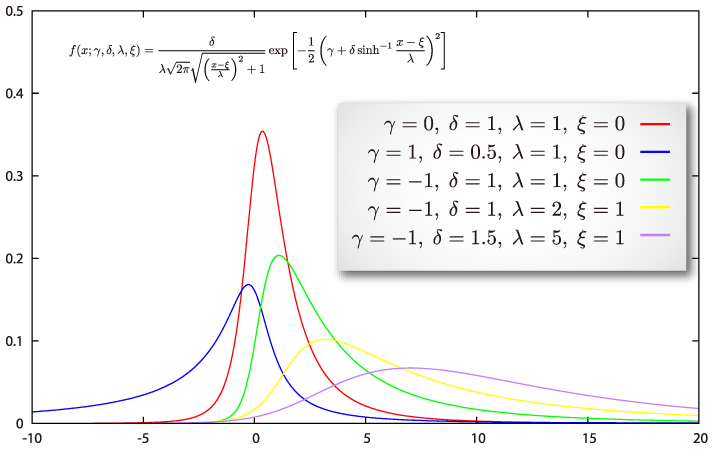

Fat-Tail Risk Awareness

Capturing fat-tail risk is one of the biggest challenges risk managers face when calculating VaR. Fat tails exhibit extremely high kurtosis than normal distribution and need a different set of statistical tools to analyze. Systems that use only normal distribution to model a portfolio implicitly assume that fat-tail risk is negligible and this can lead to flawed VaR calculation.

One of the unique features of NtInsight is the implementation of Johnson’s SU-normal distribution. With this feature, you can model and include extreme or black swan events in your scenario analysis or stress testing.

A Johnson SU distribution offers a wide range of skewness and kurtosis that makes it ideal for approximating fat-tailed distributions.

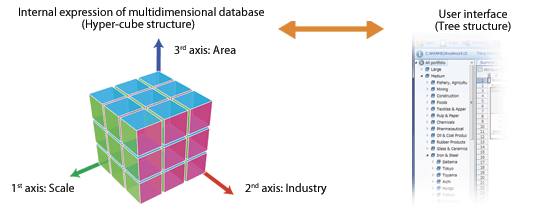

Online Analytical Processing (OLAP)

Get a bird’s-eye view of your portfolio using NtInsight. You can analyze the entire portfolio’s risk profile as well as view risk by business unit, by region, by industry, or by other predefined segments. To view risk in detail, NtInsight provides a drill-down capability that can take you from the top structure of the enterprise’s portfolio to its transactions or cash flows. All these operations are performed on-the-fly, in less than a second.

Perform multidimensional analysis through hyper-OLAP cube.

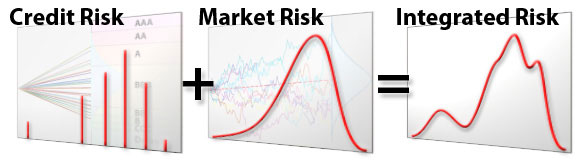

Integrated Correlation Risk

NtInsight can calculate integrated VaR and the correlation effect among market risk factors and credit risk factors. This integrated approach to risk measurement and management gives a comprehensive view of your risk exposure and can help avoid underestimating overall risk.

NtInsight supports an integrated approach to managing and measuring risk.

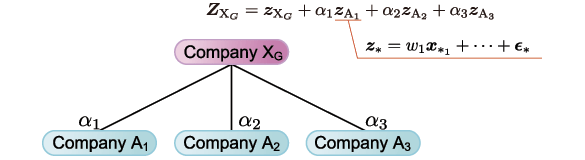

Advanced Obligor Correlation

Typically, an obligor’s risk profile is described according to country, industry, or stock indices. NtInsight extends this feature and gives you the flexibility to link an obligor’s risk profile even to economic indicators. Furthermore, NtInsight has a unique feature that describes the correlation between groups of companies. This feature takes into account the stronger correlation among such companies where capital ties or strong trade relationships exist.

With NtInsight’s unique company grouping feature, you can factor in specific obligor relationships in your simulation.