NtInsight® for Liquidity

A support of funding liquidity requirement, LCR and NSFR, to identify and manage liquidity vulnerabilities.

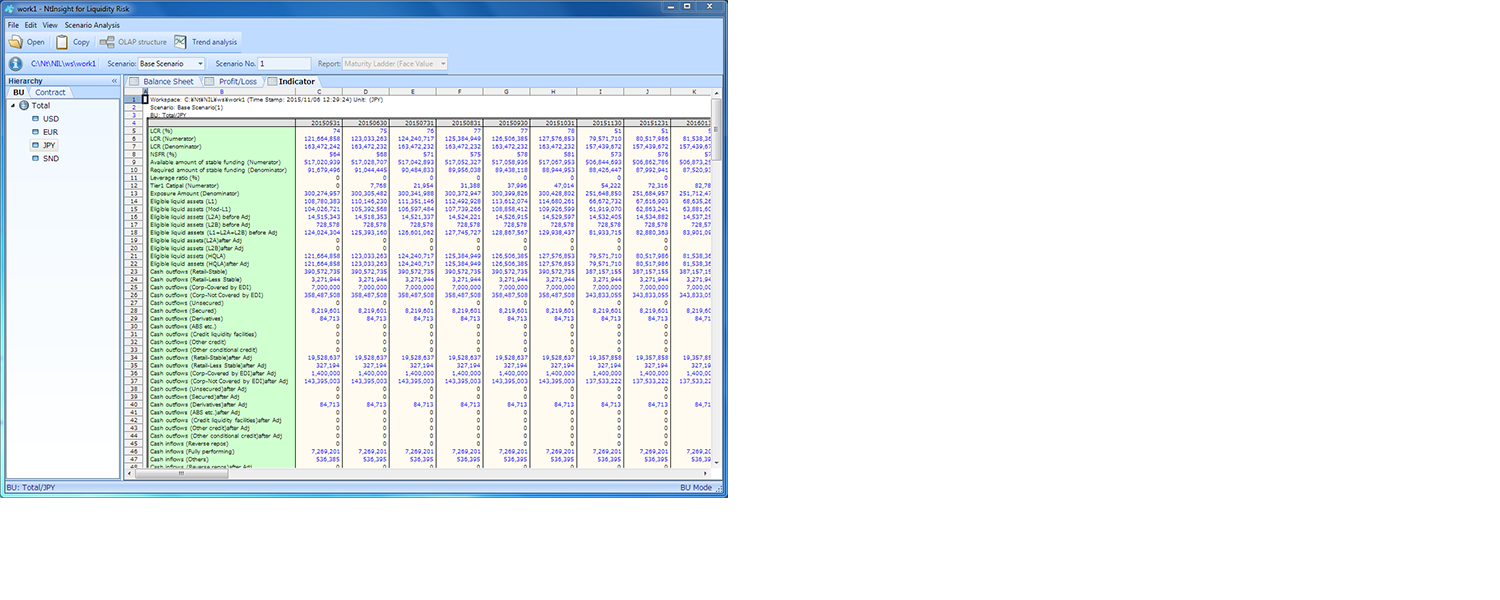

NtInsight for Liquidity Risk is a comprehensive solution that identifies and manages liquidity vulnerabilities, promotes regulatory compliance through the support of standards such as the Basel III funding liquidity requirements LCR and NSFR, and provides in-depth analytic and reporting tools.

Flexibility

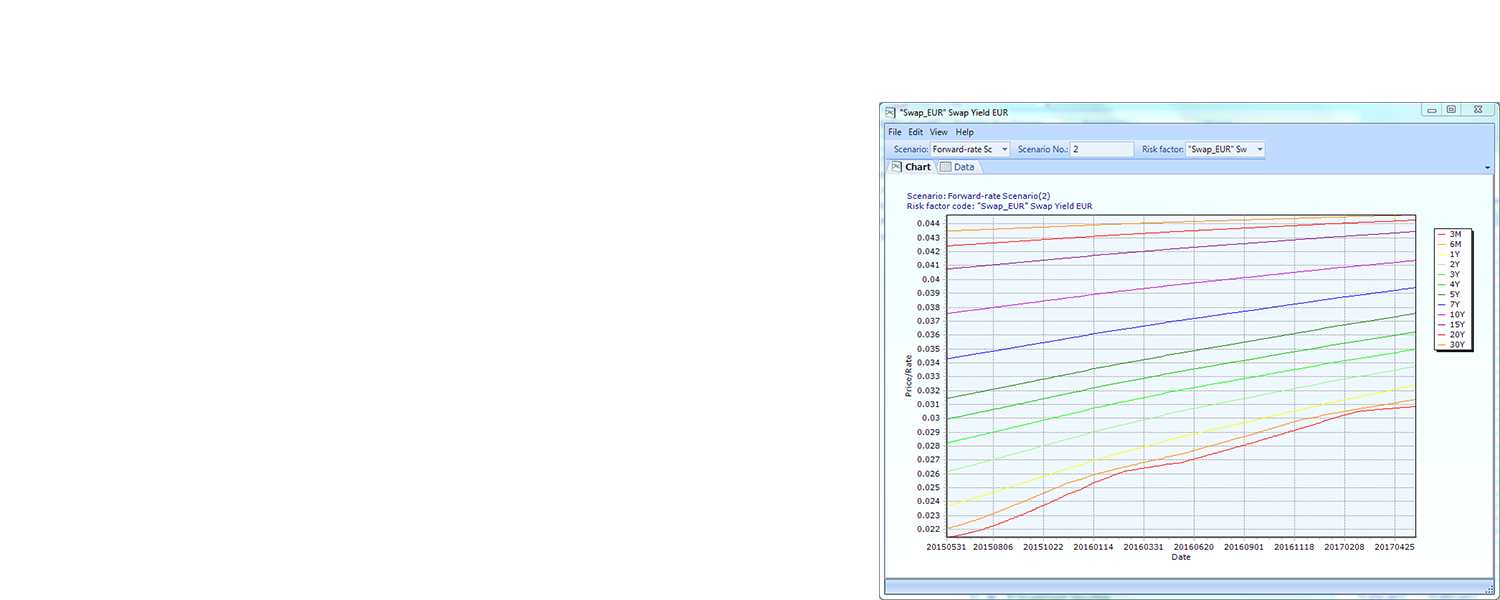

Adapt to regulatory changes such as changes in rates used in LCR and NSFR calculations.

Transparency

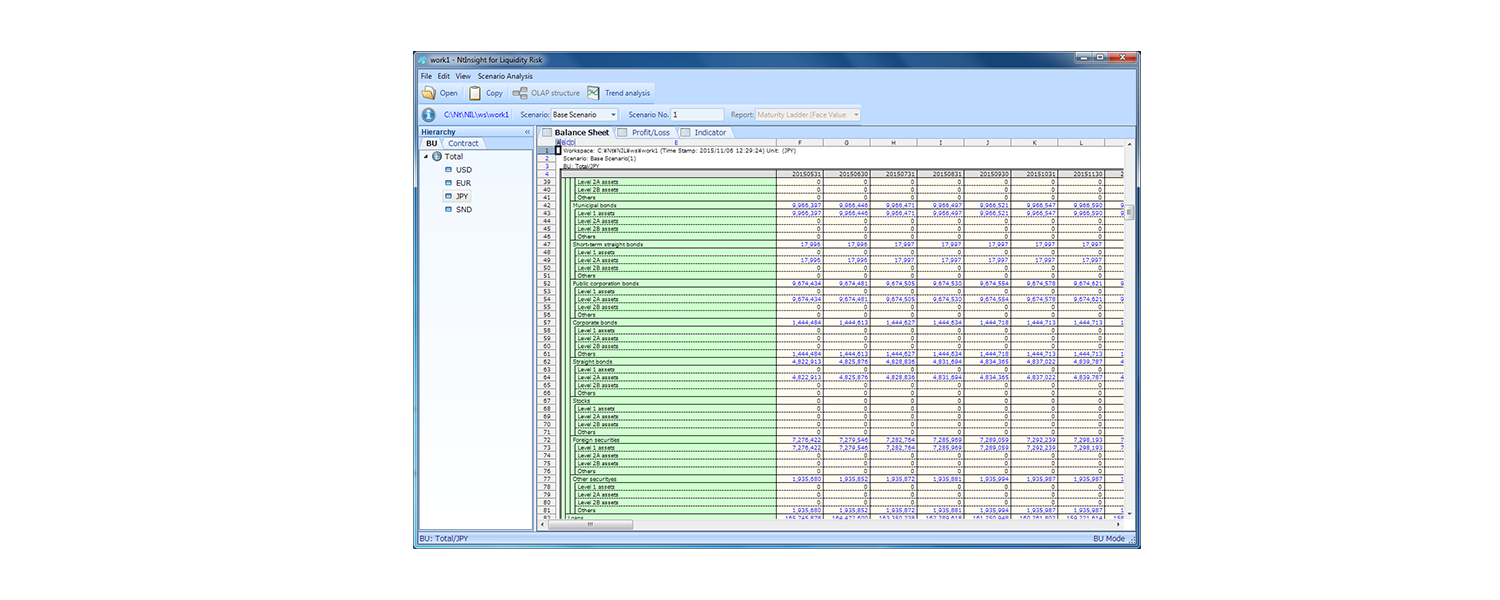

Trace and review every figure used in liquidity ratio calculation, for example, chart of account, account balance, and cash flow information. The system supports not only regulatory indicators but also monitoring indicators related to liquidity risk including maturity ladder, suppliers list, and currency LCR.

Expandability

Add new subsidiaries and include these in your liquidity calculation with minimal effort.

Reliability

Get accurate results from a proven platform. NtInsight for Liquidity Risk is powered by the same engine that runs NtInsight for ALM, a solution that has been widely used by major financial institutions in Japan for over a decade.

Upgradeability

NtInsight for Liquidity Risk is easily upgradeable to NtInsight for ALM, a system that provides professionals an integrated balance sheet management environment to monitor, analyze, and manage liquidity risks, interest-rate risks, and earnings-at-risk.