Numerical Technologies prides itself in producing innovative, technologically-advanced risk management systems. Its continuous R&D in areas such as HPC (high-performance computing) and RNG (random number generator) is one reason why Numerical Technologies has been competitively successful in the industry and why most major financial institutions in Japan have selected NtInsight® as their risk management software.

Awards

Asia Risk Technology Rankings 2014

Third, Best Innovative Specialist Vendor Category

Asia Risk Technology Rankings 2013

Winner, Best Innovative Specialist Vendor Category

Large-Scale Data and High Performance Computing

High performance computing (HPC) has broad applications in computational finance. Among other things, it can be applied to options pricing, securities and derivatives valuation, and financial risk management. The increasing need to transform large-scale data to useful information coupled with the increasing demand to generate this information faster have accelerated the development demand for HPC in finance. NtInsight for ALM is one of the few financial risk management software applications that have been optimized to take advantage of highly-parallel systems and platforms. It has been designed to scale large UNIX- and Windows-based cluster-computing environments. With NtInsight for ALM you can:

-

Unlock business-critical information from large-scale data with precision and speed.

NtInsight for ALM is equipped with sophisticated analytic tools that, when combined with its high-performance computing capabilities, allow it to process billions of transactions per simulation.

-

Take advantage of advances in hardware technology.

NtInsight for ALM is capable of managing multiple processors and nodes in a cluster environment. When you invest in additional hardware not only will NtInsight for ALM adapt to the expanded environment, you can expect it to improve performance exponentially.

NtInsight for ALM’s Performance on TSUBAME

The scalability of NtInsight for ALM on cluster-computing platforms has been proven not only on our clients’ cluster-computing environments but also on TSUBAME, which the TOP500 Supercomputer Sites ranks as one of the world’s fastest supercomputers today.

| Dataset | |

|---|---|

| Number of instruments | 3,400,000 |

| Cash flows | 500,000,000 |

| Transactions | 4,400,000,000/scenario |

| Counterparties | 200,000 |

| Simulation periods | 3 years on a daily basis |

| Server size | 135 nodes or 2,160 cores |

| Accounting rule | Mark to Market |

NtInsight for ALM elegantly scales over 1,500 cores on TSUBAME. In this experiment, the portfolio of the largest commercial bank in Japan was used as input.

High-Quality Random Number Generator

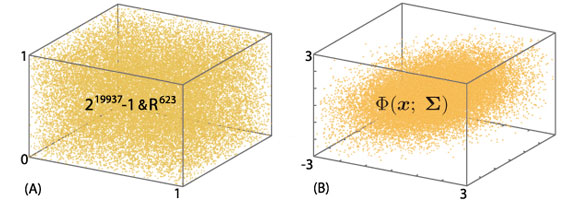

A high-quality pseudo-random number generator (RNG) is important in financial risk management because the simulation of an entire financial institution’s portfolio requires a huge set of random numbers. One such high-quality pseudo-RNG is Mersenne Twister. Developed by Professor Makoto Matsumoto in 1997, Mersenne Twister features a period of 219937-1 and has become today’s de facto standard in high-quality pseudo-RNG. Numerical Technologies has been collaborating with Professor Matsumoto since he developed Mersenne Twister, and has fully implemented the pseudo-RNG in its NtInsight financial risk management software applications. Numerical Technologies has also created NtRand®, an RNG add-in for Microsoft Excel that has promoted Mersenne Twister as a standard in the financial industry as well as the scientific community.

NtInsight produces well-correlated random numbers (B) based on a set of uniformly distributed random numbers (A) generated using Mersenne Twister.

Robust Monte Carlo Engine

One of the biggest users’ concerns is that actual historical market data may cause mathematical errors when textbookish methodologies, such as Cholesky decomposition, are used. Such errors produce meaningless results and can be hard to identify when using a black-box system. This can cause risk managers to significantly underestimate VaR. We understand these concerns and provide carefully selected math techniques to handle them.

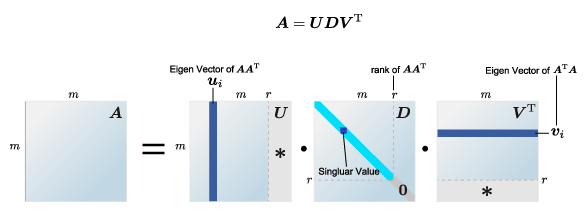

Singular value decomposition (SVD) is one of the techniques that NtInsight uses to express real-world requirements in its calculations.