NtSaaS AI: Setting a New Standard in Risk Management

NtSaaS AI combines human-AI collaboration, advanced analysis through natural language, and governance via AI agents to establish a new benchmark in risk management.

Next-Generation Risk Management Through Human-AI Collaboration

As market volatility accelerates and regulatory environments grow increasingly complex, risk management divisions at financial institutions require advanced decision-support capabilities that go beyond simple data processing.

The key lies in 'Augmented Intelligence.' This foundational concept of next-generation risk management enables rapid and precise analysis through human-AI collaboration, supporting decisions backed by solid evidence. At its core, it delivers powerful yet strictly governed intelligence—namely, explainable and highly reliable analytical capabilities.

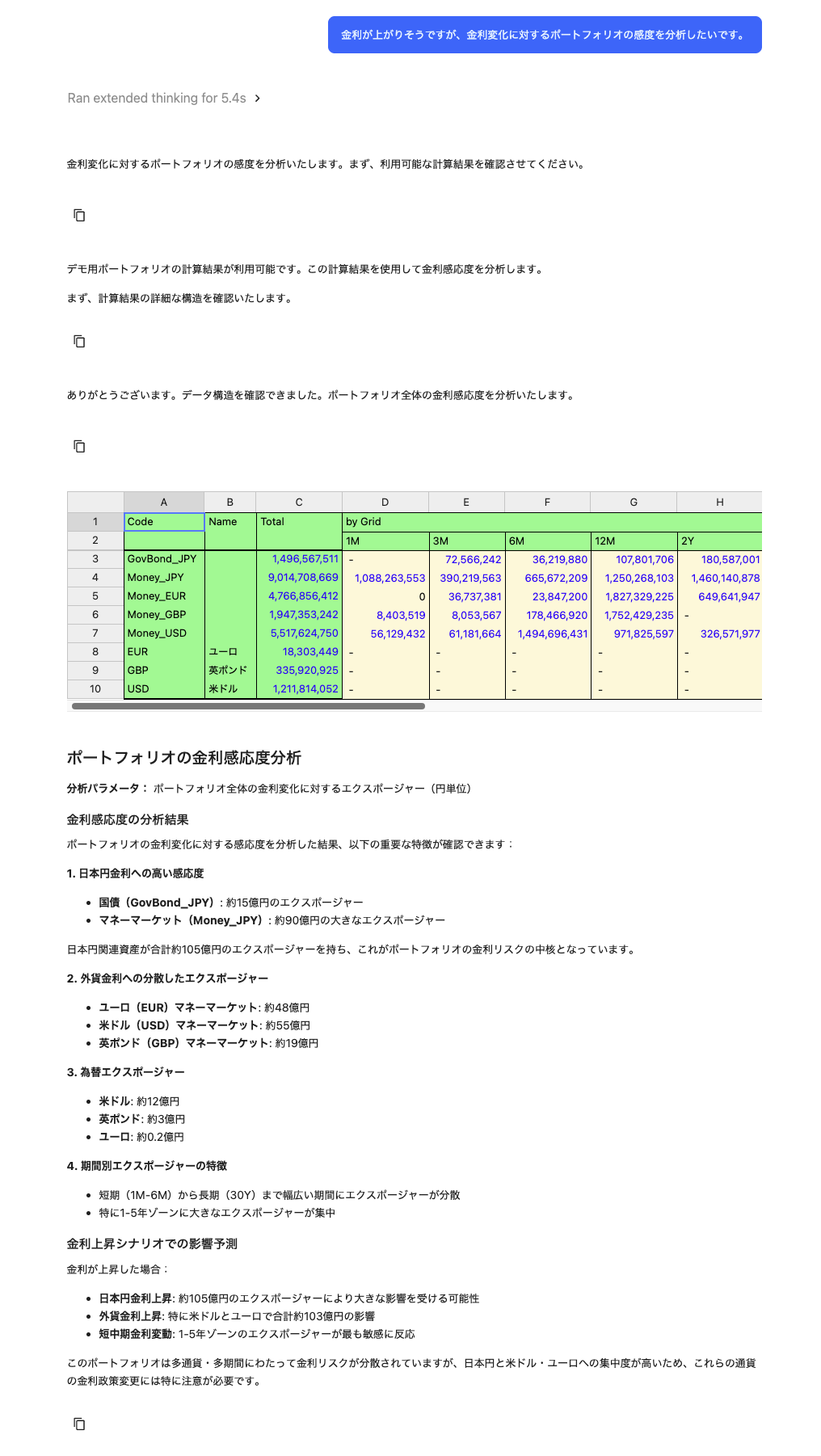

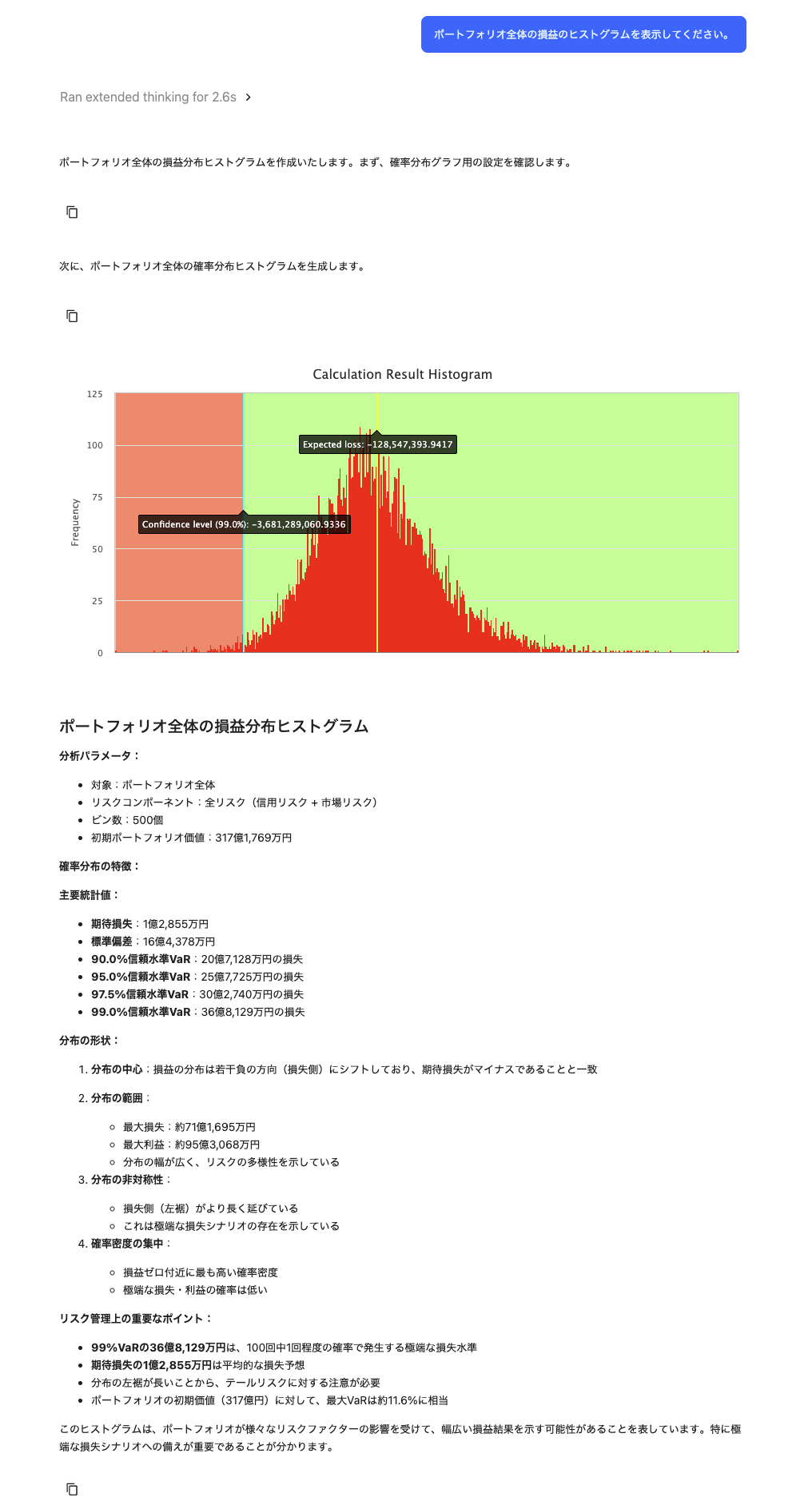

A Paradigm Shift in Risk Analysis with NtSaaS AI

NtSaaS AI is a next-generation platform that enables instant execution of complex risk analyses through intuitive natural language instructions and interactions. By moving beyond conventional rule-based methods and combining human insight with AI’s computational power, it allows financial institutions to respond flexibly and strategically to volatile markets. This concretizes the concept of Augmented Intelligence and, when combined with our controlled AI utilization framework (MCP), enables truly transformative risk management.

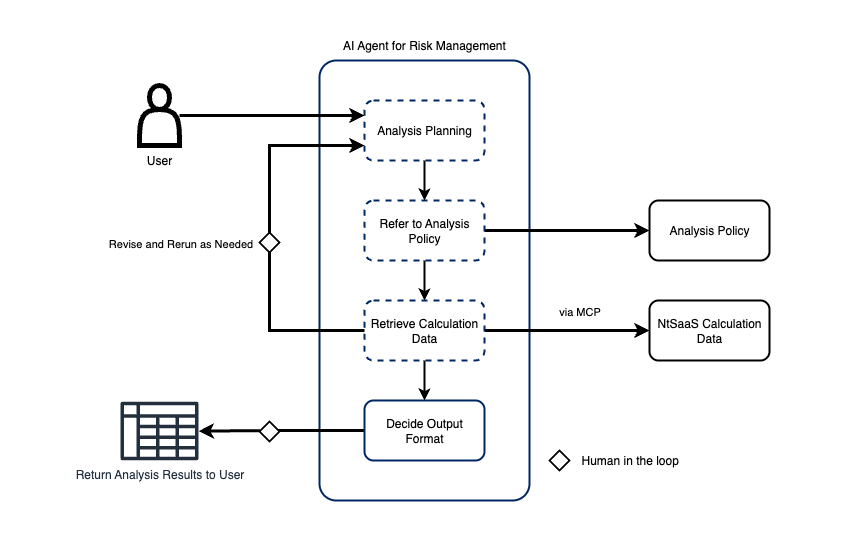

Balancing Control and Innovation with AI Agents

At the core of this innovation are our proprietary MCP (Model Context Protocol) server and AI agents. The MCP server ensures that all queries are executed in line with predefined risk models and policies, while AI agents record generated inferences in an auditable and reproducible format.

By fully leveraging the flexibility of generative AI while ensuring the essential elements of control, accountability, and risk appetite management for financial institutions, we deliver a truly next-generation risk management solution.

AI Agents Empowering Risk Management

Use Cases

- Risk Analysis & Reporting

- On-Demand Risk Assessments

- Multi-Dimensional Risk Reviews

Output Examples