Supports ERM, ORSA, and Solvency II

Market Consistent Valuation (MCV) for insurance liabilities and economic value-based balance sheet.NtInsight® family of risk management software solutions supports the implementations of ERM, ORSA, and Solvency II, all of which are required to calculate the fair value of insurance assets and liabilities. NtInsight for ALM, in particular, conducts fair valuation by proxy function and produces economic value-based balance sheet.

Parallel Computing and Acceleration

Insurers should cover, at the very least, non-life insurance risk, life insurance risk, market risk, credit risk, and operational risk. The calculation of the economic value of enterprise risk takes a long time. Replicating portfolio can reflect economic risk factors such as market factors but is difficult to expand to mortality risk, survival risk, and non-economic factors like modification of contract condition and cancellation. Leveraging on parallel computing and acceleration which we have acquired over high performance computing field, we have updated feature to perform full valuation of each insurance cash flow in NtInsight.

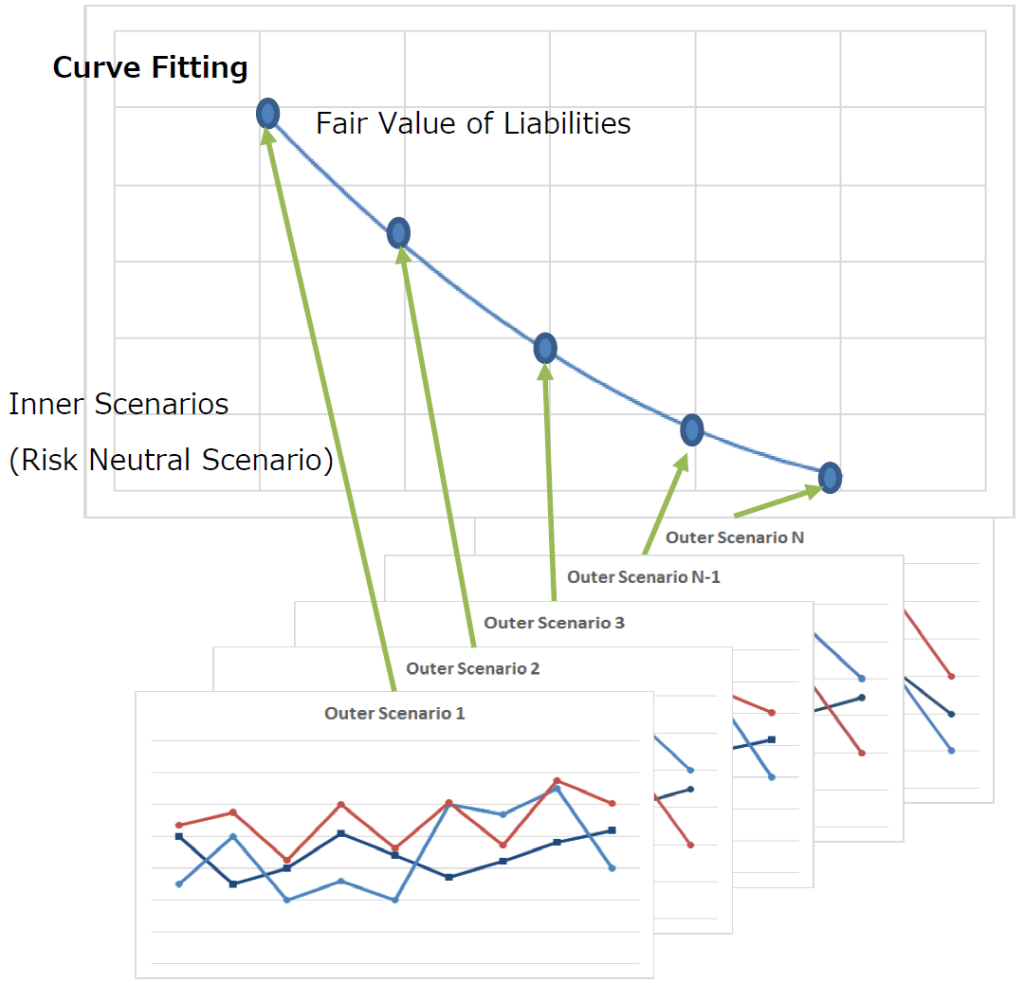

Proxy Function and Curve Fitting

Outer scenarios (i.e., real-world scenario of risk factors) are needed to perform market-consistent valuation. NtInsight creates scenarios internally and also supports loading of externally created scenarios. These scenarios are generally multivariate data that takes correlation into account. NtInsight applies proxy function to these scenarios and calculate economic value-based assets and liabilities using a polynomial.

Expansion to ERM and ALM

In addition to economic value-based analysis, ORSA requires a forward-looking analysis that is based on the institution’s business strategy and conducted from a medium-term perspective of about 3 to 5 years. While valuating complex insurance liabilities, NtInsight runs multi-period simulation of multiple maturities and calculates economic value-based risk indicators. NtInsight is able to reflect future investment planning because it can buy new transactions and sell existing transactions depending on the business plan and the market environment.