NtInsight® for ALM

An integrated balance sheet management environment to monitor, analyze, and manage liquidity risks and interest-rate risks.

NtInsight® for ALM is a financial risk management software for banks and insurance companies that handles massive and complicated financial simulation without oversimplified approximations. It provides asset/liability management professionals an integrated balance sheet management environment to monitor, analyze, and manage liquidity risks, interest-rate risks, and earnings-at-risk.

Key Differentiators

Numerical Technologies provides a financial risk management software that manages enterprise-wide asset and liability information that is more precise than any other in the market. The NtInsight for ALM advantage includes:

- An asset/liability management framework that can integrate credit risk.

- Capability to generate financial scenarios at daily resolution.

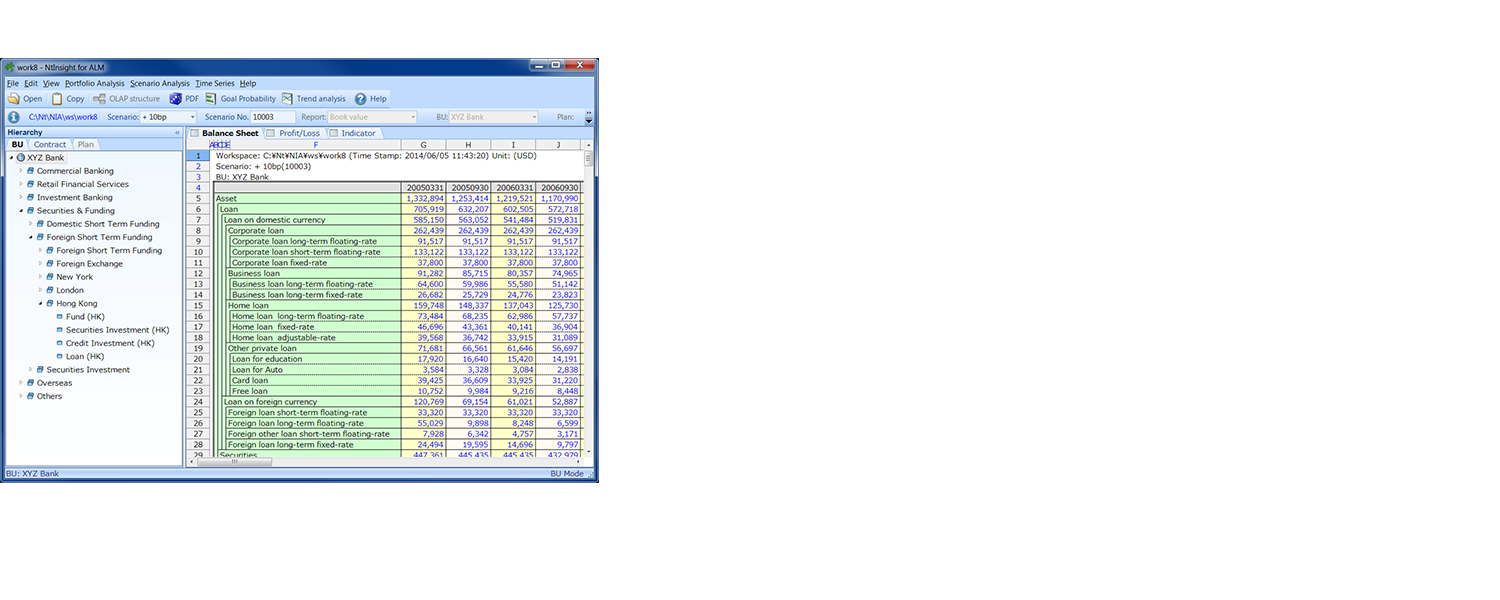

- Precise financial statements that show account balance in detail.

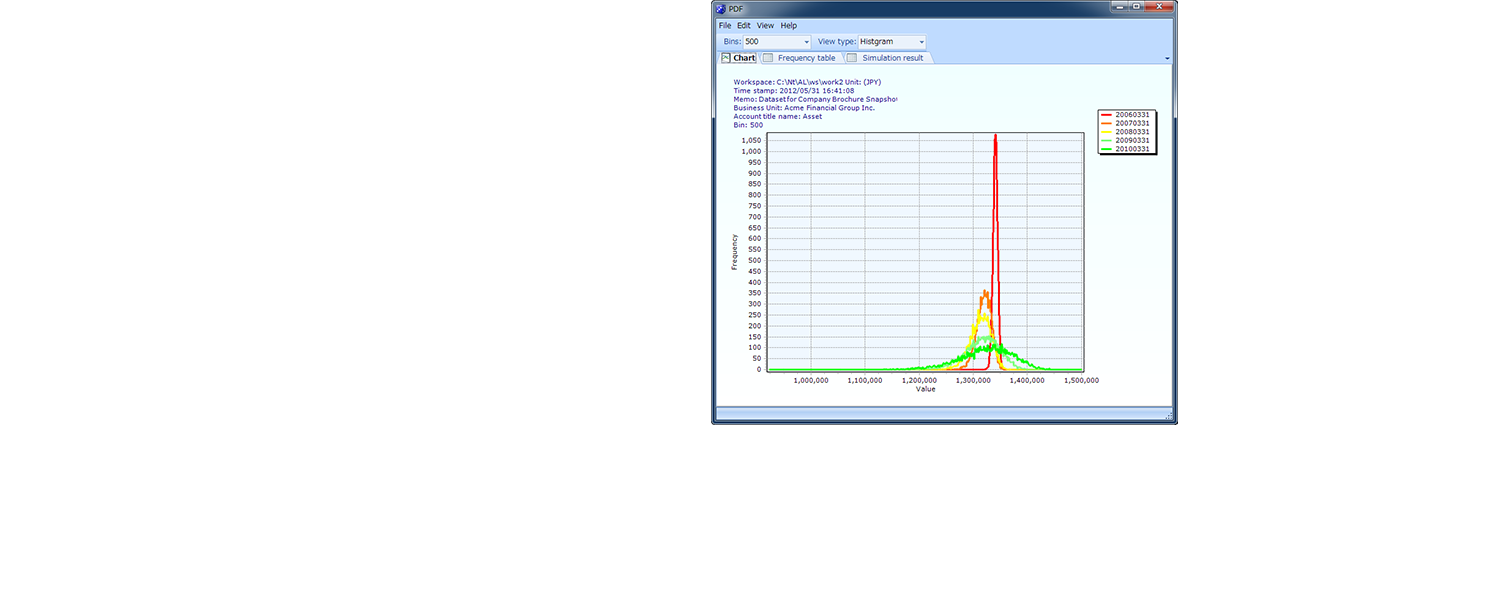

- Robust Monte Carlo Simulation engine.

Balance Sheet Management and Portfolio Optimization

NtInsight for ALM provides:

- Built-in prepayment models to value mortgage loans.

- What-if analysis capabilities to optimize hedge operations.

- Mark-to-market and accrual accounting methods of valuing investment portfolio.

Risk Indicator Calculation

Calculate traditional risk indicators such as modified duration, effective duration, and convexity, and measure asset and liability mismatch using gap analysis or maturity ladder.

Net Interest Income Simulation

Measure and manage net interest income in a simulation-based environment using funds transfer pricing (FTP).

Earnings-at-Risk Simulation

Evaluate potential changes in cash flows or earnings through Monte Carlo simulations. You can create interest-rate scenarios using principal component analysis (PCA).

Regulatory Capital Requirement Support

NtInsight for ALM supports the Basel II/III and Solvency II capital regulation framework requirements.